TAXES FOR INDIVIDUALS

How is the income tax in Cyprus calculated?

As of 2020, everyone who receives income from wages, rents, royalties, pensions, dividends, interest, and profits from share transactions, which may be exempt from income tax and/or special contribution for defense, must file a personal income tax return. But for two years now (2020 and 2021), the Cypriot Government has delayed forcing individuals earning less than €19,500 to file their income tax.

Previously, individuals who earned below that threshold were not required to fill in a tax return and pay income tax. Now, from 2023, everyone will have to file a tax return, regardless of their income. The tax on the first €19,500 remains zero.

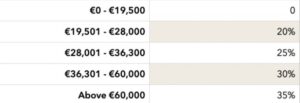

Amounts of personal income tax in Cyprus

Income Amount (€)

How do I complete a tax return?

The Tax Department of the Republic of Cyprus electronically accepts personal income tax returns (Form T.D.1) through the TAXISnet portal (https://taxisnet.mof.gov.cy).

Form T.D.1 must be filed by employees, retirees, and self-employed persons (whose annual turnover is less than 70,000 euros). These categories of taxpayers do not have to file a financial report, which is subject to an obligatory audit.

Currently, in 2023, residents of Cyprus whose total annual income is less than €19,500 are exempted from the obligation to file a declaration of income tax unless these people received a formal request for such reporting (Council of Ministers Decree No. 51/2022, published in the “Government Official Newspaper” of 4 February 2022).

REGISTRATION ON THE TAXISNET PORTAL IN CYPRUS

A newly established company is a tax resident of Cyprus. To carry out operational activities to ensure tax residency, including applying the Cyprus double taxation avoidance agreements provisions, the company must be registered with the Tax Authority, which is a body under the Ministry of Finance (Tax Department). This has to be done within 60 days after incorporation.

Some companies, which are not “holding companies” but carry out real activities, will probably also have to be registered for VAT when their revenue reaches €15,600 or more.

To obtain a taxpayer identification number, it is necessary to complete a special form. To become a VAT payer, you must also submit the corresponding application. It should be noted that a separate department in the tax administration is responsible for the VAT administration.

You can register and obtain an identification number (and VAT, if applicable) in person or online. The whole procedure takes one day and is free of charge.

Regarding VAT, it should also be noted that companies that sell or plan to sell goods or services to other European countries must register with the VAT Information Exchange System (VIES), a centralized information exchange system between the tax authorities of European countries concerning VAT. It’s possible to do this online after being authenticated in TAXISnet.

If a company employs staff, it must also register with the Ministry of Labour and Social Security to pay social security contributions. As a rule, this is done at the same time as registering with the tax authority. This service is also free of charge.

How can I register with the Cyprus tax authorities?

All legal entities registered in the territory of the Republic of Cyprus, as well as individuals who are tax residents of Cyprus and whose gross annual income exceeds €19,500, are required to obtain the status of income taxpayer.

Registering with the Tax Service and creating a TAXISnet account is necessary. To register with the Tax Service, the completed form TD 2001 must be submitted to any of the District Offices of the Tax Service or the Nicosia office of the PSC (so-called “Point of Single Contact Service”). Those already registered but wish to change their data should submit the completed form TD 2003 to the nearest district office of the Tax Service.

Along with the completed application form, originals and copies of other documents will be required, in particular:

- Cypriot nationals: a copy of the Cypriot identity card.

- EU citizens: a copy of the registration certificate from the Department of Registration and Migration.

- Third-country nationals: copy of residence permit.

- Legal entities (companies): copies of company registration certificates, registered office, directors and secretary, shareholders (if applicable).

Individuals and companies not registered in Cyprus must provide an identification document (e.g., individual tax number, identity card, social security number) and an official letter signed by the individual or company representative explaining the reasons for registration with the Cyprus Tax Authority.

It is necessary because submitting declarations and paying taxes in Cyprus is only possible electronically. Registration in the register of taxpayers and issuance of the registration certificate takes one to three working days. After receiving the registration certificate, the taxpayer must then register in the TAXISnet system. When registering, two separate accounts must be created for income tax and VAT by selecting the appropriate section on the portal.

How can I make a correct tax payment?

Tax payments must be made electronically using the unique number assigned when filing the tax return. The Tax Department accepts electronic payments through the JCC Smart Portal (https://www.jccsmart.com) and Tax Portal systems (https://taxportal.mof.gov.cy).

FREQUENTLY ASKED QUESTIONS

If a person lived in Cyprus for less than 180 days per year and earned more than €19,500, do they file a declaration?

If this person worked in Cyprus and earned more than €19,500, they must file an income tax return, regardless of the length of time they lived in Cyprus.

Suppose a person has lived in Cyprus for a long time but never filed a return (his income has always been less than €19,500). How can he find out if he has a tax number?

Everyone who registers in the system will receive a letter with a unique registration number for TAXISnet. If no such letter has been received, the person must contact the Tax Department and register.

How do I properly prepare documents for filing an income tax return?

Before you start filling out the IR1 form:

- Ask all employers for confirmation that you have worked during the tax year and payroll records showing your wages (IR63 forms).

- Request from your employer proof of payments to GESY, payment of social security contributions, and proof of any other deductions and taxes paid.

During filling in:

- Before selecting the code in IR1 (type of income, etc. ), ensure you understand and are confident that the code you selected is correct.

- If you are a Cyprus tax resident, declare your worldwide income and all taxes paid abroad.

What are the most frequent problems in completing the tax declaration?

Problems often arise with specifying the correct amounts and filling the columns correctly. Also, sometimes there needs to be a clearer understanding of how the final declaration form should look like, i.e., what should be sent in the end. And another important point that very often causes difficulties is that only some understand what benefits or reimbursements they are entitled to. As a result, they do not get what they are entitled to by law, or they overpay.

How can I avoid filing my tax return mistakes and consider all entitlements and reimbursements?

There are two options: study the tax legislation in depth or ask a specialist for advice and assistance. Often the second option helps to save much more money. The consultation fee for filing the tax return varies from 80 to 150 euros plus VAT).